When a $120 OEM seal fails in 9 months and a $27 aftermarket seal runs for years, which one was the “quality” choice? This question challenges the assumption that the OEM label automatically means superior performance.

Seal failures account for 60-70% of all centrifugal pump maintenance work, making seal selection one of the highest-impact decisions for maintenance budgets. Across the industry, we’re seeing a more nuanced reality: supplier evaluation skills matter more than the OEM vs aftermarket label. A rigorous aftermarket supplier can outperform a careless OEM distributor. This article provides the framework to evaluate both.

The OEM vs Aftermarket Distinction

OEM seals come from the original equipment manufacturer or their authorized distributors. Aftermarket seals come from third-party manufacturers who produce compatible replacements.

The traditional view holds that OEM guarantees fit and quality while aftermarket offers cost savings with higher risk. Reality is more complicated. Some aftermarket suppliers manufacture to OEM specifications using equivalent materials. Some OEM channels deliver mishandled or even counterfeit products.

The binary thinking fails in practice. Sometimes OEM is better. Sometimes aftermarket matches OEM specs exactly. And sometimes OEM supply chains fail while aftermarket suppliers deliver. Quality depends on specific supplier capabilities, not the label on the box.

OEM seals currently dominate the market with approximately 60% share. This reflects risk aversion more than proven quality differences. Many buyers choose OEM to avoid blame if something fails, not because they’ve verified superior performance.

What Actually Determines Seal Quality

Quality depends on measurable specifications that any manufacturer, OEM or aftermarket, can meet or fail to meet.

Material Specifications

Brad Gillispie, VP at SPX Process Equipment, identified the real quality differentiators: “The parts are lacking in something – tolerances, material specification, hardness – and all those things have a lot to do with performance.”

Material grades matter. A seal labeled “silicon carbide” can be reaction-bonded or alpha-sintered – with very different performance characteristics. Elastomer compounds vary widely. A Viton O-ring from a quality supplier differs from a generic FKM compound with inconsistent properties.

Documentation separates quality suppliers from questionable ones. Can they provide material certifications? Test reports? Traceability to raw material sources?

Dimensional Accuracy and Testing

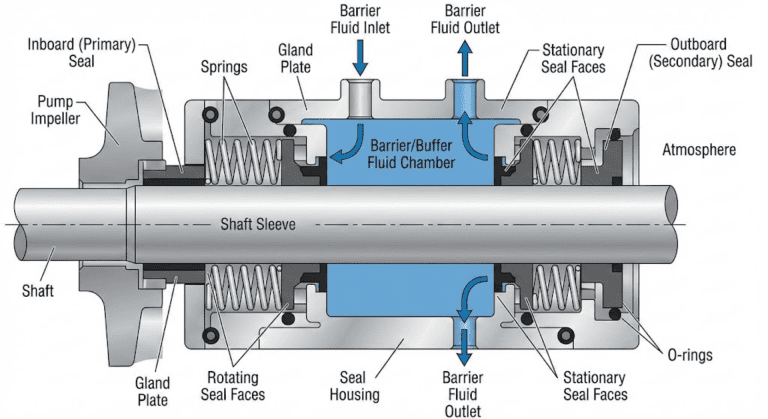

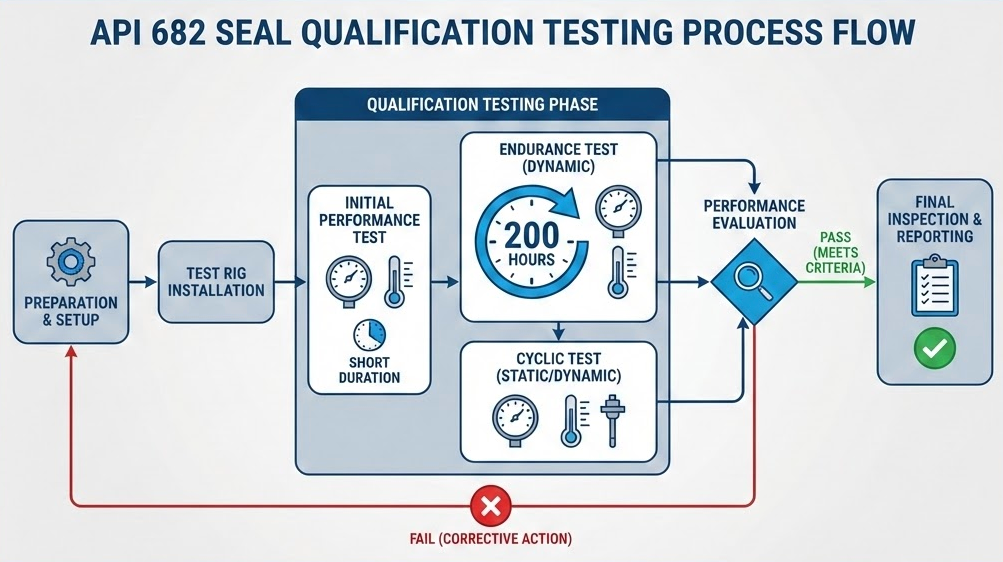

API 682, the industry standard for pump shaft sealing systems, specifies that seals should achieve continuous operation of at least three years (25,000 operating hours). The standard requires qualification testing that can take up to 200 hours per seal type.

These requirements apply equally to OEM and aftermarket manufacturers. An aftermarket supplier running full API 682 qualification testing demonstrates more commitment to quality than an OEM distributor who simply passes along whatever the factory shipped.

A Texas food processor learned this lesson expensively. Their gearboxes kept failing prematurely despite using what they believed were OEM parts sourced through local repair shops. Investigation revealed the parts were substandard counterfeits. The short-term savings evaporated when accounting for increased repair frequency. The “OEM” label on the box meant nothing because the supply chain had failed.

Comparing Total Cost of Ownership

The hidden cost most buyers miss is that initial seal cost typically makes up less than 10% of total cost of ownership. Purchase price is the wrong metric.

TCO includes:

- Purchase price

- Installation labor

- Unplanned downtime (can reach $100,000 per hour in critical applications)

- Mean time between failures

- Secondary equipment damage from seal failures

- Inventory carrying costs

Premium seals can achieve 40% lower lifecycle cost over five years despite 20% higher upfront costs. Modern sealing systems can increase mean time between repairs by up to 50% compared to older technologies. The math favors quality regardless of origin.

A chemical plant in a corrosive environment upgraded to specialized seals at higher initial cost. They achieved ROI within 18 months through reduced shutdowns and extended service life. The investment paid back and then kept saving money year after year.

When comparing replacement versus repair costs, the same principle applies: the cheapest option on paper often costs more in practice.

Evaluating Seal Suppliers

The thesis proves itself in practice: your ability to evaluate seal suppliers determines outcomes more than the OEM vs aftermarket label.

What to Ask

Request documentation before ordering:

- Material certifications with specific grades (not just “silicon carbide” but what type)

- Dimensional inspection reports

- Quality system certifications (ISO 9001 minimum, API 682 compliance where applicable)

- Test procedures and results

- Lot traceability

A supplier who cannot or will not provide this documentation is a red flag regardless of OEM status.

Red Flags

US Customs and Border Protection seized more than 211,000 counterfeit automotive parts in 2024, nearly double the previous year. Counterfeiters target high-margin components and produce look-alike parts at 20-40% of OEM costs.

Watch for:

- Prices well below market (if it’s 20-40% of typical OEM cost, question how)

- Inability to specify exact materials and grades

- No certifications or third-party verification

- No technical support or failure analysis capability

Quality Chinese seal manufacturers exist alongside low-quality producers. Origin tells you nothing; capability assessment tells you everything.

Warranty Protection

Many buyers fear that aftermarket parts void OEM equipment warranties. The Magnuson-Moss Warranty Act provides legal protection: it is illegal for equipment manufacturers to require use of their branded parts to maintain warranty. The burden of proof falls on the OEM to demonstrate that an aftermarket part caused the damage.

Document your supplier selection rationale. Keep certifications on file. This protects your purchasing decision if warranty questions arise.

One more protection: knowing when seal quality isn’t the problem. Heinz Bloch’s analysis of 11,000 mechanical seal failures found that 13% were attributable to bearing maintenance issues, not the seal itself. When seals fail, investigate root cause before assuming seal quality—or your supplier choice—was the problem.

Making the Decision

Evaluate the application first. Critical pumps handling hazardous materials in continuous operation warrant more thorough supplier qualification. Utility water pumps in non-critical service allow more flexibility.

Then evaluate the supplier, not the label. Can they document material specifications? Do they have a quality system? Will they support you if something fails?

The middle-ground principle often holds: the most expensive seals may carry brand premiums without proportional quality gains, while the cheapest are manufactured to a price point with corners cut. But price range alone isn’t the answer. The skill that protects your pumps and your budget is supplier evaluation. Learn to ask the right questions, verify the documentation, and assess capability. That skill pays dividends across every seal you purchase, regardless of whether the box says OEM or aftermarket.