When a mechanical seal fails, downtime costs typically run 5-10 times higher than the seal itself. This math explains why OEM seal partnerships deserve strategic attention rather than routine procurement treatment.

Across the industry, we’re seeing a shift from transactional seal purchasing to supplier partnerships. Heavy industry plants face downtime costs as high as $128 million annually, according to Siemens research. The right OEM partnership can cut this exposure through better seal reliability, faster response times, and proactive support.

This guide provides a framework for evaluating OEM mechanical seal supply partnerships across five dimensions: technical capability, quality systems, supply chain reliability, partnership services, and total cost of ownership.

Evaluation Criteria for OEM Seal Suppliers

The hidden cost most buyers miss is evaluation depth. A certificate check and price quote don’t reveal whether a supplier can actually solve your sealing problems.

Technical Capability and Certifications

Start with API 682 certification if you’re in petroleum or chemical processing. This standard requires Seal Qualification Testing before market release, meaning the supplier has demonstrated their seals meet industry-specific performance thresholds.

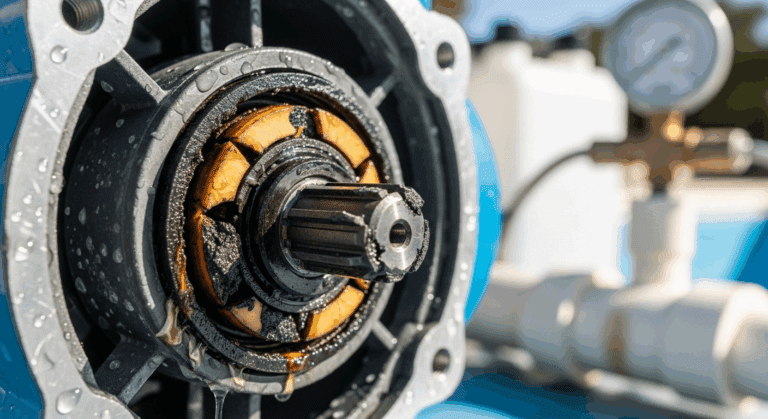

Can the supplier reformulate compounds for your specific application? One naval valve manufacturer faced repeated seal failures until their supplier proposed fully molded seals on 800-ton compression vacuum presses. That plant ran eight years with zero seal failures, and the seals could be reused during scheduled refurbishment.

Suppliers spending 7% or more of revenue on development typically bring innovation rather than just copying existing designs.

Quality Systems and Consistency

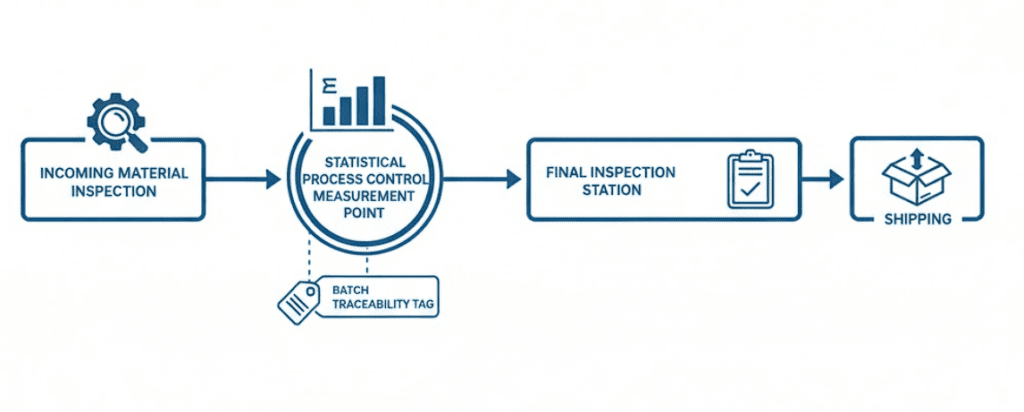

ISO 9001 certification is baseline. Look deeper at statistical process control implementation and batch-to-batch consistency. Defect rates above 2% signal systemic quality problems, not random variation.

Traceability from raw material to finished product protects you during failure analysis. Without it, identifying root causes becomes guesswork.

Supply Chain Reliability

A supplier promising two weeks but delivering in four creates more operational problems than one consistently delivering in six.

Ask about safety stock practices, contingency plans for disruptions, and whether they operate multiple production facilities. Single-point-of-failure suppliers become your single point of failure.

Partnership Support Services

SEPCO identifies four foundational elements for seal durability: proper installation, material compatibility, operating conditions, and lubrication. Your supplier should support all four through application engineering, training programs, and failure analysis services.

When comparing options, the key factors are response time for technical questions and willingness to conduct on-site assessments. A supplier who needs three days to answer basic technical questions will leave you stranded during emergencies.

Based on field data from multiple sites, modern sealing systems can increase mean time between repairs by up to 50% compared to older technologies. But this improvement requires partnership-level engagement, not just product delivery.

Total Cost of Ownership Analysis

Purchase price represents only 10-20% of what a mechanical seal actually costs you. A $500 premium seal lasting five years costs far less than a $400 seal requiring replacement every 18 months.

The Fluid Sealing Association provides a Life Cycle Cost Estimator Tool that evaluates sealing systems by analyzing reliability, cost, and energy consumption across a defined timeframe. This structured approach enables objective comparison beyond unit pricing.

One municipal water systems partnership demonstrates the math. After reformulating superior diaphragm material within 15 business days, the supplier enabled a 25% warranty extension. Annual savings from their automated piercing process: $50,000. That’s the partnership value procurement spreadsheets often miss.

The ROI calculation framework is straightforward. A $5,000 seal upgrade investment yielding $1,500 in energy savings, $2,000 in maintenance reduction, and $3,000 in downtime avoidance returns $6,500 annually. Payback: approximately nine months.

Mechanical seals can account for up to 25% of a pump’s total power consumption. Energy-efficient designs from quality suppliers compound savings over the seal’s operating life.

Sourcing Strategy: Single vs Multi-Vendor

The single-source versus multi-source debate has a practical answer for most operations.

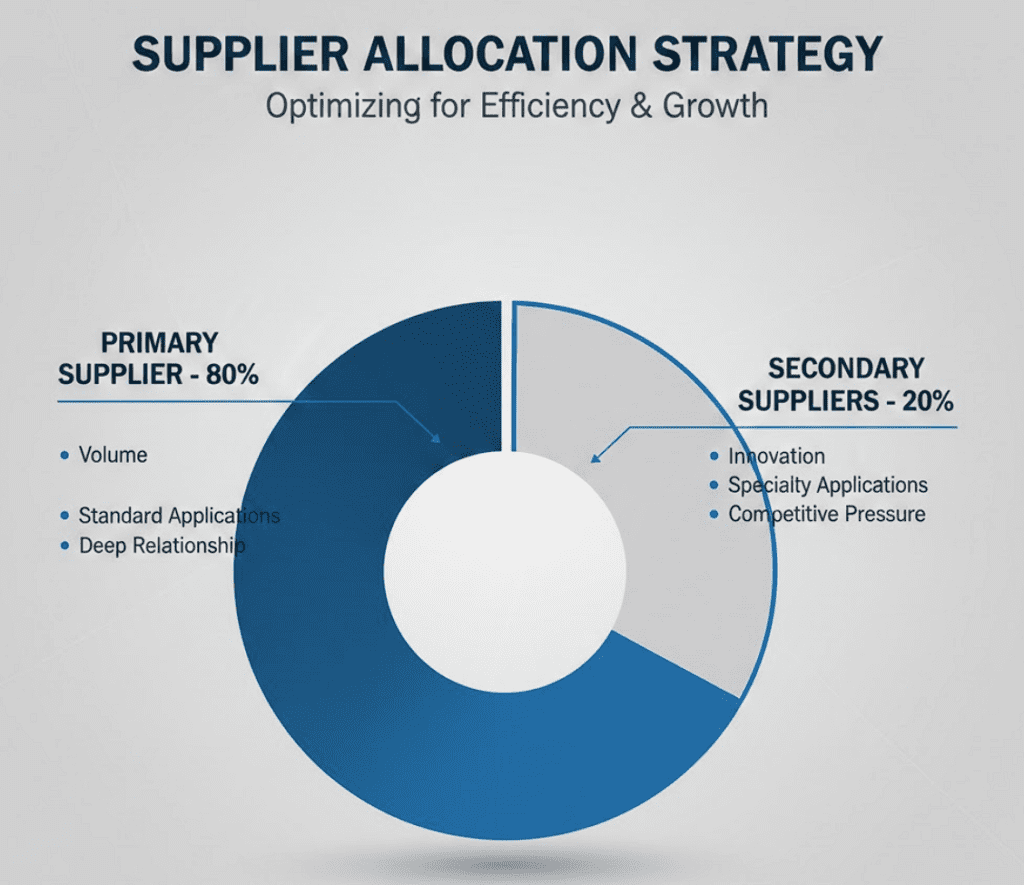

Single-source partnerships offer deeper relationships, volume discounts, simplified procurement, and consistent quality. Multi-source strategies provide innovation exposure, competitive pricing pressure, risk mitigation, and prevent supplier complacency.

Heinz P. Bloch, founding board member of the Texas A&M International Pump Users’ Symposium, recommends the 80/20 approach: “Making a plant an 80/20 percent plant can reap benefits far in excess of a mere percentage reduction in the cost of mechanical seals originating from a single source.”

The rationale extends beyond cost. Including second-tier manufacturers exposes you to innovation and service quality you might otherwise miss. Your primary supplier handles 80% of volume and standard applications. Secondary suppliers at 20% keep the primary honest and bring alternative solutions for challenging applications.

For critical applications, multi-source with clear primary/secondary designation balances relationship depth against supply chain risk.

Red Flags When Evaluating Suppliers

Some warning signs should end evaluation immediately.

Pricing red flags: Quotes well below market indicate corner-cutting on materials or quality control. Sustainable leading mechanical seal manufacturers operate within recognizable cost structures.

Communication red flags: Days to answer basic technical questions. Unwillingness to share process information or certification documentation. Vague references instead of verifiable track records.

Quality red flags: Defect rates above 2% of production output. No statistical process control implementation. Infrequent or superficial incoming inspections.

Facility red flags: Outdated machinery without calibration certificates. Single-sourcing critical components without backup plans.

One pool filtration OEM learned this lesson expensively. Their offshore supplier created ongoing warranty claims and liability exposure in chlorine-exposed applications. The eventual solution required reformulating compounds with improved compression stability and chemical resistance. The partnership with a capable domestic supplier ultimately protected them from class action lawsuit exposure, with 900,000 seals now in service with zero field failures.

Next Steps for Your Evaluation

Start by calculating your current seal replacement vs repair costs and annual seal spend. This baseline reveals whether partnership investment is justified and identifies which applications deserve priority attention.

Score potential suppliers across the evaluation criteria using a simple high/medium/low framework. Request failure analysis reports from their existing customers in similar applications. Visit facilities where possible, specifically observing quality control processes rather than showroom capabilities.

The suppliers worth partnering with will welcome this scrutiny. Those who resist detailed evaluation are telling you something important about their confidence in their own operations.