Your Chinese supplier has an ISO 9001 certificate on their website. Can you verify it’s real? Do you know whether that certification actually means their seals will perform?

Across the industry, we’re seeing dramatic quality variation among Chinese mechanical seal manufacturers. Industry data shows a 30% AQL failure rate in Chinese manufacturing overall—meaning roughly one-third of products fail to meet specifications. Yet the same data shows 59% of audited factories pass compliance reviews. The difference between these numbers reveals the core challenge: quality exists in China, but finding it requires knowing how to verify claims.

This guide provides the practical verification process you need. You’ll learn how to check certifications, what documentation to request, when third-party inspection pays for itself, and which red flags should end a supplier conversation immediately.

Understanding Quality Variation

The most common source of quality inconsistency isn’t capability—it’s supply chain management. Most Chinese manufacturers maintain multiple material sources: Factory A provides highest quality at higher prices, Factory B offers lower quality at cheaper prices. When buyers pressure on price without specifying quality requirements, suppliers often default to cheaper sources for subsequent orders.

This explains why initial samples meet specifications while production batches disappoint. The sample came from Factory A. Your bulk order came from Factory B.

When comparing options, the key factors extend beyond the manufacturer’s own capabilities to their supplier management practices. A factory with impressive equipment can still produce inconsistent seals if their raw material sourcing lacks controls.

Certification Verification

ISO 9001 certification indicates a quality management system exists—it does not guarantee product quality. Many buyers assume any certified supplier is safe. In reality, ISO 9001 relates to process documentation, not product performance. BSCI certification, often displayed alongside ISO, relates to social compliance, not manufacturing quality at all.

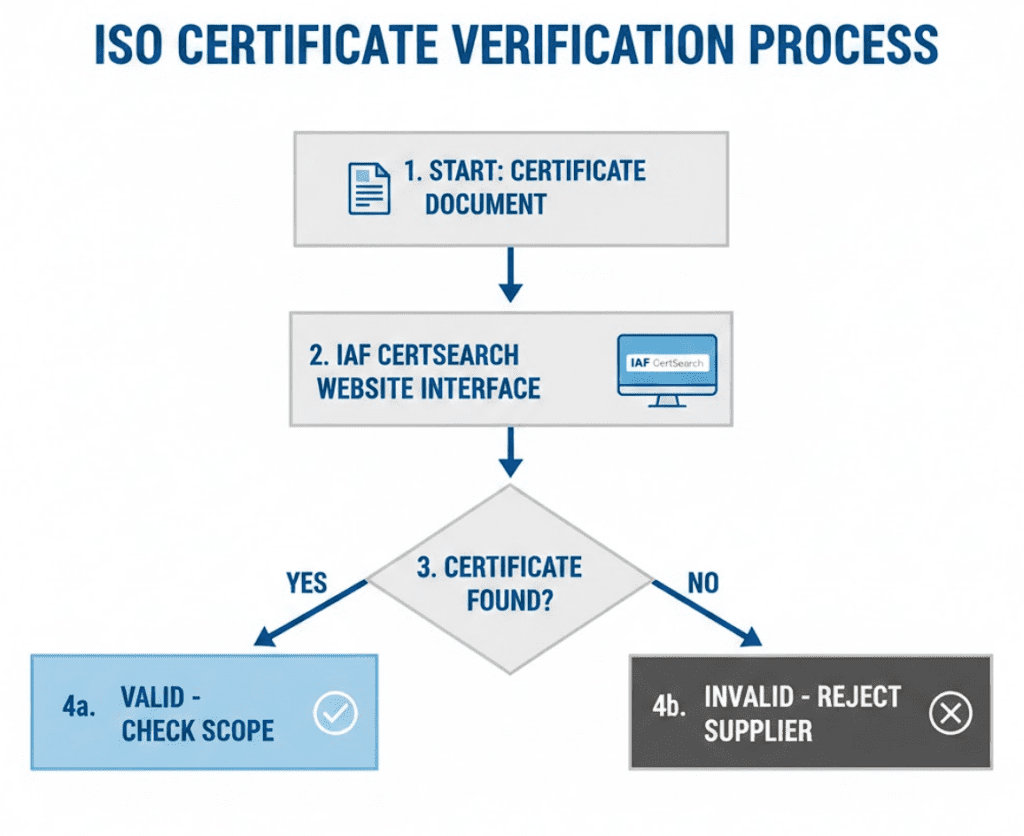

ISO 9001 Verification Process

Verify any ISO certificate through the IAF CertSearch database (iafcertsearch.org). Enter the company name or certificate number and confirm:

- Certificate is currently valid (not expired)

- Accreditation body is recognized (UKAS, ANAB, or equivalent)

- Scope of certification covers mechanical seal manufacturing specifically

- Company name matches exactly—variations suggest separate legal entities

Fake certificates typically show missing accreditation logos, vague company details, or unknown issuing bodies. If online verification fails, the certificate is worthless.

API Certification for Petroleum Applications

For oil and gas applications, API-certified seals meet rigorous testing requirements. API 682 qualification testing simulates three years of reliable service through extended performance tests lasting up to 200 hours. The test protocol combines steady-state operation with simulated process upsets.

When a manufacturer claims API certification, request the specific qualification test reports. Generic claims without documentation should raise concerns.

Documentation and Material Traceability

Certifications alone don’t reveal manufacturing practices. Request specific documentation that shows what actually happens on the production floor. Based on field data from multiple sites, suppliers who resist providing these documents typically have something to hide:

Material Test Certificates (MTC): Every batch of seal face materials—silicon carbide, tungsten carbide, carbon graphite—should have corresponding MTCs verifying compliance with ASTM, DIN, or ASME standards. Request sample certificates before placing orders.

Positive Material Identification (PMI): For critical applications, ask whether the supplier uses XRF analyzers to verify elemental composition of incoming materials. This catches substituted or mislabeled materials before they enter production.

Batch Traceability: Can the supplier trace a finished seal back to specific raw material lots? This capability indicates mature quality systems. Suppliers who cannot provide lot traceability typically lack the internal controls to maintain consistency across orders.

Dimensional Inspection Reports: Request sample inspection reports showing actual measured dimensions versus specifications. The format and detail level reveals inspection rigor—or lack thereof.

Third-Party Verification Options

The hidden cost most buyers miss is remediation. Catching a quality issue at the source costs roughly 10 times less than discovering it after shipment. For significant orders, third-party verification often pays for itself on the first prevented failure.

| Service Type | Typical Cost | Duration | When to Use |

|---|---|---|---|

| Supplier Verification | $50-100 | 24 hours | Before initial contact—confirms legitimacy |

| Factory Audit | $250-650/day | 1-2 days | Before first order—assesses capability |

| Pre-shipment Inspection | $150-320/day | 1 day | Each order—catches defects before shipping |

| Full Compliance Audit | $1,200-2,500 | 2-5 days | High-value relationships—detailed review |

Major inspection companies like SGS, Bureau Veritas, and Intertek operate extensively in China. QIMA offers competitive rates (around $309/man-day) with broad coverage. For cost-sensitive buyers, companies like TESTCOO provide inspections starting from $149/man-day.

For orders under $5,000, inspection costs may exceed potential savings. For orders above $30,000, skipping inspection is penny-wise and pound-foolish. Between those thresholds, assess based on application criticality and supplier track record.

Red Flags and Warning Signs

When sourcing seals from China, the price of serious development and manufacturing mistakes is usually paid by the buyer. These warning signs should prompt immediate caution or termination of discussions:

Newly Registered Companies: Verify registration date through China’s National Enterprise Credit Information Publicity System. One sourcing manager discovered a suspiciously low-priced supplier had registered only months earlier with minimal capital and unclear business scope. New companies lack the track record to trust with critical applications.

Residential Addresses: Legitimate manufacturers operate from industrial zones. Residential addresses suggest trading companies reselling others’ products—eliminating any quality control between factory and buyer.

Personal Bank Accounts: Requests for payment to personal accounts instead of company accounts indicate either informal operations or outright fraud.

Refusal of Factory Visits or Video Calls: Suppliers unwilling to show their facilities have reasons for hiding them.

Self-Issued Certificates: Any certification not verifiable through independent databases should be considered fraudulent.

Vague Responses About Suppliers or Processes: Legitimate manufacturers know their supply chain. Evasive answers suggest the supplier lacks control over their own quality.

For buyers seeking vetted options, established Chinese seal manufacturers with documented track records reduce—though never eliminate—sourcing risk.

Your Supplier Evaluation Checklist

Start with verification before engagement. Check business registration dates and legitimacy through NECIPS. Verify any claimed certifications through IAF CertSearch. Confirm industrial zone location.

Request documentation early. Ask for sample Material Test Certificates, dimensional inspection reports, and batch traceability examples. Suppliers who provide these readily demonstrate mature quality systems.

Evaluate first orders carefully. Order samples with defined specifications. Consider third-party inspection for production batches. Specify quality requirements in writing—including material grades and testing requirements.

Protect yourself contractually. For orders above $30,000, use Letters of Credit with quality inspection as a release condition. Below that threshold, Alibaba Trade Assurance provides meaningful protection for platform vendors.

Build verification into ongoing relationships. Quality that starts strong can deteriorate when price pressure increases. Periodic inspections and consistent documentation requirements maintain standards across the relationship lifecycle.

The total cost of ownership for mechanical seals extends far beyond purchase price. A seal that fails prematurely costs installation labor, production downtime, potential equipment damage, and replacement parts. Due diligence during supplier selection prevents these costs from materializing.